Investors often assume that similar investments will yield comparable results, yet the reality can be starkly different. Exploring this phenomenon, this article delves into why two seemingly identical investments can exhibit significant variations in outcomes. With HDFC SKY from HDFC Securities as a backdrop, it highlights the nuances that can impact investment performance.

Market Conditions and Economic Factors

Market conditions and economic factors play a crucial role in shaping the investment landscape for traders and investors on platforms like HDFC SKY by HDFC Securities. Understanding market conditions involves analyzing factors such as supply and demand dynamics, investor sentiment, economic indicators, and geopolitical events that impact asset prices. For instance, changes in interest rates by the central bank can influence borrowing costs, which in turn affect consumer spending and business investments. Economic factors like GDP growth, inflation rates, and employment data provide valuable insights into the overall health of the economy and can guide investment decisions.

CAGR Calculator is an essential tool for investors looking to evaluate the annual growth rate of their investments. Understanding the compound annual growth rate aids in assessing the performance of various assets, helping investors to make informed decisions by comparing historical returns against broader market trends and economic forecasts.

Moreover, market conditions are inherently volatile and subject to various external influences, making it essential for investors to stay informed and adapt their strategies accordingly. Factors such as global trade tensions, political developments, and technological advancements can create both opportunities and risks in the market. A platform like HDFC SKY, with its comprehensive range of investment options and expert research tools, equips investors with the necessary resources to navigate changing market conditions effectively. By staying attuned to economic factors and market trends, investors can make informed decisions to optimize their investment portfolios and achieve their financial goals.

Diversification Strategies

Diversification strategies are essential for investors looking to minimize risks and optimize returns in their investment portfolios. HDFC SKY, by HDFC Securities, provides a comprehensive platform for investors to diversify their investments across a wide range of asset classes. By offering access to Indian equities, ETFs, mutual funds, IPOs, derivatives, commodities, currencies, and global stocks, investors can spread their investments across different sectors and geographies. This diversification helps in reducing the correlation between assets, thereby lowering the overall portfolio risk. Additionally, HDFC SKY’s zero account-opening charges and flat brokerage fees make it cost-effective for investors to explore and invest in different asset classes without incurring high transaction costs.

Moreover, HDFC SKY’s provision of interest-bearing margin trading and expert research tools further enhances the diversification strategies for investors. Margin trading allows investors to leverage their investments, potentially increasing their returns while expert research provides valuable insights and recommendations to make informed investment decisions across various asset classes. The intuitive tools offered by HDFC SKY make it easier for investors to monitor and manage their diversified portfolio efficiently. Overall, by incorporating diversification strategies through HDFC SKY, investors can build a well-balanced and resilient investment portfolio that is better positioned to weather market fluctuations and capitalize on opportunities in different asset classes.

FD Calculator tools offered by HDFC SKY provide additional support for investors seeking to manage their fixed deposit investments effectively. These calculators help investors determine potential returns, allowing them to plan their financial goals strategically. By providing comprehensive solutions, HDFC SKY empowers investors to align their investments with their long-term objectives.

Timing of Investment Decisions

The timing of investment decisions is a crucial aspect that can significantly impact the success of an investor. With HDFC SKY, investors have a modern discount-broking platform at their fingertips to help them make informed decisions. This platform offers seamless access to a wide range of investment options such as Indian equities, ETFs, mutual funds, IPOs, derivatives, commodities, currencies, and global stocks. The zero account-opening charges and flat ₹20-per-order brokerage fee make it cost-effective for investors of all levels to engage in the market. Furthermore, with lifetime free ETFs, interest-bearing margin trading, expert research, and intuitive tools, investors can stay ahead of market trends and make well-informed investment decisions.

When it comes to investing, timing is everything. The tools and resources provided by HDFC SKY empower investors to make timely and strategic investment decisions. Whether investors are looking to capitalize on short-term market movements or build a long-term investment portfolio, having access to expert research and intuitive tools can help them navigate the complexities of the financial markets. By leveraging the benefits of HDFC SKY, investors can optimize their investment strategies and seize opportunities as they arise. Ultimately, the timing of investment decisions plays a crucial role in achieving financial goals and maximizing returns, and with HDFC SKY, investors have the support they need to make informed decisions at the right time.

Risk Management Approaches

Risk management is a crucial aspect of any investment strategy, and HDFC SKY by HDFC Securities offers various approaches to help investors mitigate and manage risks effectively. One of the key risk management approaches provided by HDFC SKY is expert research. Through in-depth analysis and insights from market experts, investors can make more informed decisions, reducing the likelihood of making high-risk investments. This research-based approach allows investors to have a better understanding of market trends, potential risks, and opportunities, enabling them to adjust their portfolios accordingly to minimize potential losses.

In addition to expert research, HDFC SKY also offers intuitive tools that aid investors in assessing and managing risks. These tools provide real-time market data, risk assessment models, and portfolio analysis features that empower investors to monitor their investments closely and identify potential risks early on. By utilizing these tools, investors can implement risk management strategies effectively, such as diversification, stop-loss orders, and hedging techniques. Overall, these risk management approaches play a vital role in helping investors navigate the complexities of the financial markets and safeguard their investments against unforeseen risks.

Industry-Specific Trends

Industry-specific trends in the financial services sector are constantly evolving with the digital transformation of brokerage services. HDFC SKY, by HDFC Securities, exemplifies this trend by offering a modern discount-broking platform that caters to the needs of contemporary investors. With the increasing popularity of online trading platforms, HDFC SKY provides seamless access to a wide range of investment products, including Indian equities, ETFs, mutual funds, IPOs, derivatives, commodities, currencies, and global stocks. The platform’s zero account-opening charges and flat brokerage fee per order make it an attractive option for cost-conscious investors looking to maximize their returns.

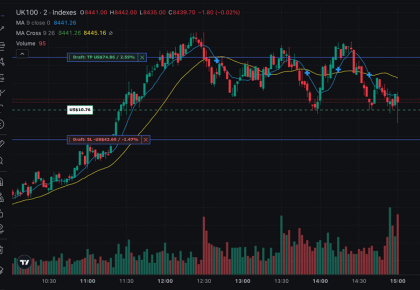

suzlon share price has garnered significant attention as investors are keenly observing the renewable energy sector’s performance. With HDFC SKY’s advanced analytics and user-friendly interface, tracking and analyzing such stocks becomes easier. As industry trends favor green investments, platforms like HDFC SKY are well-positioned to support informed decision-making for sustainable investment opportunities.

Moreover, HDFC SKY’s focus on providing value-added services such as interest-bearing margin trading, expert research, and intuitive tools reflects the industry’s shift towards offering comprehensive solutions to meet the diverse needs of investors. By integrating advanced technology and personalized support, HDFC Securities is capitalizing on the trend towards more customer-centric and user-friendly brokerage platforms. As the financial services sector continues to embrace digital innovation and automation, industry-specific trends like those embodied by HDFC SKY are reshaping the way investors engage with the markets and manage their portfolios.

Impact of Geopolitical Events

Geopolitical events have a profound impact on global financial markets, including the Indian equities market accessible through HDFC SKY by HDFC Securities. Geopolitical tensions, such as trade wars, political instability, or military conflicts, can create uncertainty and volatility in the stock markets. For instance, announcements of tariffs between major economies can lead to fluctuations in stock prices of companies that are sensitive to international trade. Investors using HDFC SKY need to be vigilant of such events as they can affect their investment decisions and overall portfolio performance. Geopolitical events can also influence the prices of commodities, currencies, and global stocks available on the platform, making it crucial for investors to stay informed and adapt their strategies accordingly.

Moreover, geopolitical events can impact sectors differently, creating opportunities for investors on HDFC SKY to capitalize on market movements. For example, disruptions in the oil supply chain due to geopolitical tensions can lead to increased oil prices, benefiting energy companies while negatively affecting industries reliant on oil as a primary input. By staying updated on geopolitical developments, investors can make informed decisions on sectoral allocations within their portfolios. The expert research and intuitive tools provided by HDFC SKY can assist investors in analyzing the impact of geopolitical events on different asset classes and sectors and adjusting their investment strategies to navigate through uncertain times effectively.

Management Team Effectiveness

Management team effectiveness is a critical component of any organization’s success, and HDFC SKY is no exception. The management team at HDFC Securities plays a pivotal role in shaping the strategic direction of HDFC SKY, ensuring that it remains competitive and innovative in the dynamic world of discount broking. The effectiveness of the management team can be seen in the seamless access provided by HDFC SKY to a wide range of financial products, including Indian equities, ETFs, mutual funds, IPOs, derivatives, commodities, currencies, and global stocks. The team’s ability to offer zero account-opening charges, flat ₹20-per-order brokerage, lifetime free ETFs, interest-bearing margin trading, expert research, and intuitive tools reflects their strategic decision-making and operational efficiency.

Furthermore, the management team’s effectiveness is evident in their focus on customer-centricity and continuous improvement. By offering a user-friendly platform with a range of financial products and services at competitive rates, HDFC SKY caters to the diverse needs of its clients. The management team’s proactive approach to staying abreast of market trends, regulatory changes, and technological advancements ensures that HDFC SKY remains at the forefront of the discount broking industry. Their ability to adapt to changing market conditions and customer preferences while maintaining high levels of service quality underscores the effectiveness of the management team at HDFC Securities.

Investor Behavior and Psychology

Investor behavior and psychology play a significant role in shaping financial markets and investment decisions. Understanding the psychological aspects of investing is crucial for investors to navigate the complexities of the market effectively. Various behavioral biases such as overconfidence, loss aversion, and herd mentality can influence investment choices and lead to suboptimal outcomes. By recognizing these biases, investors can make more informed decisions and avoid common pitfalls. Emotions like fear and greed often drive market fluctuations, impacting asset prices and creating opportunities for those who can remain rational and disciplined amidst market volatility.

In the context of HDFC SKY, a modern discount-broking platform, investor behavior and psychology are essential considerations for both the platform’s users and developers. Providing users with intuitive tools and expert research can help them make informed investment decisions based on data and analysis rather than emotions. By offering transparent pricing structures and zero account-opening charges, HDFC SKY aims to attract investors who value simplicity and cost-effectiveness in their trading activities. Additionally, features like lifetime free ETFs and interest-bearing margin trading can influence investor behavior by incentivizing long-term investing and prudent risk management strategies. Overall, incorporating an understanding of investor behavior and psychology into the design and functionality of the platform can enhance the user experience and promote responsible investing practices.

Investment App users will benefit from features that prioritize user experience and educational resources. By integrating detailed market analytics and personalized alerts, users can better navigate financial markets. HDFC SKY’s commitment to supporting investors through innovative technology and reliable insights enhances the overall appeal of the platform, fostering informed decision-making.

Regulatory Environment Influence

The regulatory environment plays a crucial role in shaping the operations and offerings of platforms like HDFC SKY by HDFC Securities. As a modern discount-broking platform, HDFC SKY must adhere to various regulations set forth by regulatory bodies such as the Securities and Exchange Board of India (SEBI). These regulations govern aspects such as investor protection, market integrity, transparency, and fair practices. Compliance with these regulatory requirements ensures that HDFC SKY operates in a manner that safeguards the interests of investors and maintains the integrity of the financial markets.

In the dynamic financial landscape of India, regulatory changes can have a significant impact on the services provided by platforms like HDFC SKY. Any alterations in regulations related to brokerage charges, product offerings, margin trading, or market access can directly influence the platform’s operations and business model. By closely monitoring and adapting to regulatory changes, HDFC SKY can ensure compliance while also seizing opportunities for innovation and growth within the confines of the regulatory environment. Maintaining a strong understanding of the regulatory landscape allows HDFC SKY to stay competitive, build trust with investors, and navigate the complexities of the financial markets effectively.

External Market Influences

External market influences play a crucial role in shaping the investment landscape for platforms like HDFC SKY offered by HDFC Securities. Factors such as global economic conditions, geopolitical events, and market sentiments in other countries can impact the Indian stock market significantly. For instance, a trade war between two major economies can lead to market volatility, affecting various asset classes and investment decisions. Changes in interest rates by central banks of leading economies can also influence investor behavior and market trends, impacting the trading activities on platforms like HDFC SKY.

Moreover, currency fluctuations, commodity prices, and overall market liquidity are other external factors that can influence investment strategies and decision-making. For a platform like HDFC SKY that offers access to a wide range of investment options including global stocks, currencies, and commodities, staying abreast of these external market influences is crucial. By analyzing and understanding how these factors can impact different asset classes and markets, investors using HDFC SKY can make informed decisions and adjust their portfolios accordingly to navigate the dynamic financial landscape effectively.